Developing Australia’s Premier Nickel-Cobalt Project

- Ardea’s Kalgoorlie Nickel Project (KNP) hosts a Mineral Resource Estimate (JORC Code 2012) of 854Mt at 0.71% Ni and 0.045% Co for 6.1Mt of contained nickel and 386kt of contained cobalt. The Goongarrie Hub, within the KNP, hosts 584Mt at 0.69% nickel and 0.043% cobalt for 4Mt of contained nickel and 250kt of contained cobalt, making it the largest nickel-cobalt resource in Australia (GSWA) and globally significant. (ASX release 30 June 2023)

- Strategic partnership with Sumitomo Metal Mining Co., Ltd (SMM) and Mitsubishi Corporation (MC): SMM and MC are funding the A$98.5M Definitive Feasibility Study (DFS), validating the Project’s potential and providing access to world-class expertise. (ASX release 30 August 2024)

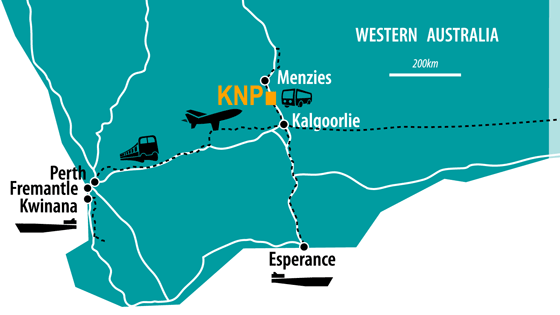

- Premier mining jurisdiction: Located in Western Australia, just 70km north of the City of Kalgoorlie-Boulder, the Project benefits from excellent infrastructure, a skilled workforce, and a stable regulatory framework.

- Potential lowest-cost producer: Goongarrie is expected to be cost competitive with global peers, thanks to premium ore quality contributing to low acid consumption and energy requirements. (ASX release 5 July 2023)

- Large scale, long-life project with expansion potential: 40+ year operational life expected, with additional expansion potential of other KNP deposits not included in PFS. (ASX release 5 July 2023)

- Innovative Ore Processing Approach: Ardea’s use of mineralised neutraliser reduces costs while providing the dual benefit of acid neutralisation and additional metal recovery, demonstrating technical innovation in project design.

- Environmentally responsible: Ardea plans for in-pit tailings and evaporation, suited to the semi-arid environment, reducing environmental risks compared to tropical locations.

- Well-positioned for growing nickel demand: Production is aligned with expected market deficits from 2029/2030 onwards.

- Experienced management team: Extensive WA resources sector experience, with a proven track record in discovery, development, and operation, and strong stakeholder relationships. Major Project Status from the Australian Federal Government has resulted in a seat at the table to give input to initiatives such as the Critical Minerals Production Tax Incentive.

- Tight capital structure: With about 210 million shares on issue and top 40 shareholders holding over 60%, Ardea has strong support from institutional investors and high-net-worth individuals.

- Funding Support: Ardea has received Conditional and Non-Binding Letter of Support from Export Finance Australia (EFA) and Letter of Interest from Export-Import Bank of the United States (EXIM) for the Goongarrie Hub. EFA and EXIM have each provided KNPL with coordinated, conditional and non-binding support for the development of the Goongarrie Hub Nickel-Cobalt project. The total conditional and non-binding support from both EFA and EXIM in aggregate is for approximately up to AUD 1 billion (equivalent). (ASX release 5 February 2026)

- Advanced DFS with near-term news flow catalysts: Regular news flow from current DFS and a clear path to Final Investment Decision.

Read Competent Persons Statement